Q&A: Nouriel Roubini

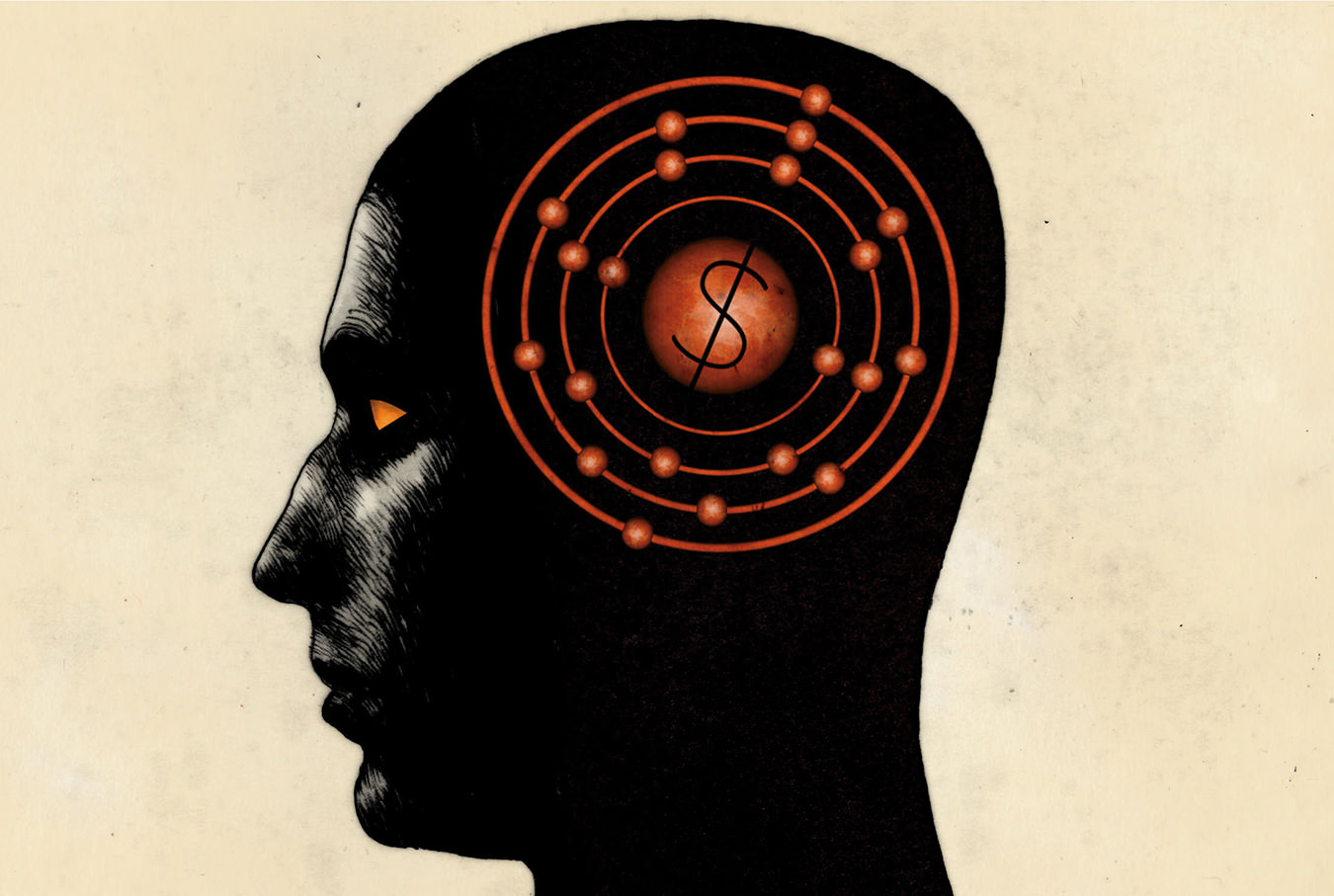

Market analysis.

Economist Nouriel Roubini is known for predicting the oil shock, the crash of the United States housing market, and the recession in 2008—somber forecasts that earned him the nickname “Dr. Doom”. Nonetheless, his critical, and often bearish, economic views have been widely cited, and in 2010, he published Crisis Economics: A Crash Course in the Future of Finance. Roubini sat down with NUVO to discuss the Canadian economy and emerging markets while touring Canada for “Books Sandwiched In”, part of Bon Mot Book Club’s speaker series.

NUVO: What do you think are the strengths of the Canadian economy? And what are the biggest issues it’s facing right now?

Roubini: The Canadian economy has decent growth, not exceptional, around 2.3 or 2.4% this year. It’s a stronger growth from domestic demand but consumption is becoming a bit softer because there is a lot of housing debt. The housing market is now correcting. Fixed investments and exports have not been very strong; there’s not much capital spending by the corporate sector. Of course, there’s a boom in the resource sector from oil sands, shale gas and oil, and natural resources—that is a source of export growth. But there’s been a correction in commodity pricing in the last year, so even the natural resource sector is seeing more moderate economic growth.

NUVO: What do you think Canadians should be thinking about from an economic standpoint as they look ahead to the next five years?

Roubini: I would say that the average consumer probably has to worry about the fact that housing debt is high, especially mortgage debt. Home prices have raised too much, and there could be a correction—hopefully not a bust, but just a correction, but it’s a risk. It’s an economy that’s very open, of course, and therefore what happens in China, what happens in the emerging markets, what happens in the United States, and what happens to the quantity of prices matters. The economy is well-managed in Canada but economic growth has been modest, job creation has been modest, so people have to think about investing in educational training, skills, and the kinds of things that allow them to be flexible to survive and thrive in this global economy.

NUVO: Where do you see Canada’s economy developing in five years from now?

Roubini: The positives are that the oil sands and shale gas and oil and overall energy revolution is going to be potentially beneficial for Canada. Of course it’s not enough to produce that stuff, you have to ship it to the final markets, whether it’s the United States or Asia, or build a pipeline to bring it into the manufacturing and refining centre in the east of Canada. But I would say that’s a positive. The only challenge there is that the strength of the non-resource sector crowds out exports in traditional manufacturing that tends to be in the east of the country because it leads to a stronger currency, and that’s one of the things that Canada will have to worry about.

There is a small probability that China might have a hard landing rather than a soft landing. There’s an expectation of a slower growth of China and of other emerging markets. Therefore, diversifying the economy and making sure that it’s not just a natural resource-based economy is going to be important because you don’t know whether China will have this hard or soft landing. Maintaining a strong manufacturing sector, financial services, and others is going to be important as a way of diversifying where you export, where you produce, and what you do.

NUVO: What are the emerging markets to watch for right now?

Roubini: Well among the risky ones, the fragile ones are India, Indonesia, Turkey, Brazil, and South Africa, who have twin current and fiscal deficits, slowing growth, and rising inflation. There are a bunch of other emerging markets that are fragile for a variety of other reasons including political risk, from Ukraine to Hungary to Russia, Argentina, Venezuela, and Thailand. But of course there are lots of very good stories, people read more in the papers about fragile ones like in Asia (Korea, Malaysia, Philippines, Hong Kong, Singapore), the dynamic economies in Eastern Europe, countries like Poland or Czech Republic. In Latin America, Brazil is fragile but Mexico, Chile, Peru, and Columbia are doing well. Or even in sub-Saharan Africa: while South Africa is not growing very much—there is social, labour strife—some of the fastest growing economies in the world right now are in sub-Saharan Africa, from Kenya to Nigeria to Angola to Mozambique to Rwanda to many others. Actually, the next decades could see strong economic growth in an original part of the world that was very poor with ethnic, religious, and civil war and strife—sub-Saharan Africa is on the rise. So, you have to look out to the new regions of the world.

NUVO: When you look at economic activity today and its consequences, what do you foresee the world economy looking like 20 years from now?

Roubini: Well, it’s hard to say where the world’s going to be 20 years from now, but I would say that globalization is going to continue, integration into the global economy is going to continue, billions of people in China, India, and other emerging markets are going to join the economy and the global labour supply. That poses a challenge for people in advanced economies because there is a lot of technological innovation, which is capital intensive and labour saving. There are many blue collar jobs, and even white collar jobs, that are substituted by people in emerging markets, and then soon enough by software and machines. Young people have to have the right skills to be able to survive in this in which there is a digital revolution. I think that’s a source of tension—we’re going to create a lot of opportunities with lots of profits, but maybe not enough jobs. Advanced economies are facing a lot of challenges: job creation, fiscal problems, even an aging population, and unfunded liability coming from the pension system and healthcare, unless we invest into our people, into our human capital.

Photo by George Pimentel.